How To Handle Your Business Finances When You’re Not Profitable Yet

Despite all the hype online, according to SmallBusinessTrends.com, only 40% of small businesses today are profitable (i.e., they have money left over after they’ve paid expenses). When you add gender to the mix, the numbers get even more real. Only 25% of women entrepreneurs earn more than $50,000/year. Of that number, only 12% make $100,000 or more. These stats are enough to make any entrepreneur wonder why they keep showing up to run their business every day.

There are many, many benefits to running your own business besides money. (I talk about a few of those reasons here.) But the truth is that most entrepreneurs continue to move forward despite their lack of revenue on the hope that they will turn a profit in the future.

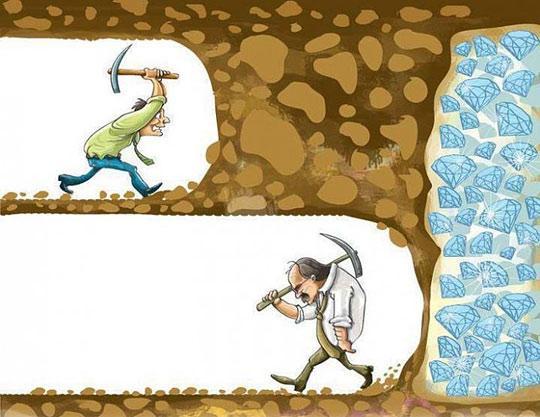

Even though we (entrepreneurs) may not be generating profits in our businesses today, we wholeheartedly that we will make the money of our dreams in the future if we just keep going. I mean, isn’t that what this Instagram photo tells us?

Entrepreneurs aren’t completely mad for having the belief that their hard work will lead to revenue, profits, and debt-free living in the future. In the past 11 years, the number of women-led businesses generating $1 million or more increased by 46%. That’s a lot of women making a lot more money than they used to. Moreover, every How I Built This podcast episode starts with an entrepreneur explaining how they either started without any money or figured out a way to stay afloat when they ran out of money. The bottom line is they kept going and built something great.

So what do you do when you are in between being totally out of money and making the money of your dreams like the majority of entrepreneurs? If this is where you are, here are some tips that can help.

#1 Realize You Are Not Alone

Even though every FB ad talks about how a business owner made 6 figures in 6 months, what they don’t talk about is the years of failure, unprofitability, and debt that came before that big revenue breakthrough. If you look hard enough, you’ll see that most of those entrepreneurs had businesses or platforms that didn’t work before they found something that did. So if that’s where you are, you are in good company. Remember, only 40% of small businesses are profitable. That means the other 60% is right in the trenches with you.

#2 Simplify + Automate = Saving Money On Expenses

Sometimes it makes sense to outsource to a freelancer or to hire someone to get things done quickly. However, if you are strapped for cash, automation can do a lot for you at a much lower price.

Use Gmail for Business’ ($5-$10/month) filters and canned response features to archive message that aren’t important and quickly reply to those that are. Use IFTTT (free) or Zapier (free to $20)) to automate communication between your apps and software. And if you must bring in help, hire a virtual assistant on Fiverr for 5 bucks. Bottom line, if a task in your business can be automated, do it. Most of the time, these automation tools will give you the most bang for your buck.

#3 Choose Business or Personal Loans over Credit Cards

If you need an injection of cash, choose a business or personal loan over credit cards. Most loans have better interest rates and terms than any credit card out there.

#4 Be Profitable First

Run, don’t walk, and read Profit First by Mike Michalowicz. I know you’re thinking, “But Toya, I don’t have any profits yet.” That doesn’t matter. The Profit First system will ensure that you have profits even when you think you don’t.

With Profit First, the equation isn’t revenue – expenses = profit, it’s revenue – profit = expenses. You pay yourself first and then use anything left over to pay your bills. This seems like a small shift, but it’s a complete game changer. Paying yourself first now, even when it feels like you don’t have any money, will go a long way toward making you the profitable entrepreneur you always wanted to be down the road.

What tips do you have for handling the finances in your business? Let me know in the comments below.